How Interest Rates Affect Real Estate: A Guide for Virginia Homebuyers and Sellers

Interest rates are one of the most important factors shaping the real estate market. They directly influence mortgage rates, which in turn affect housing affordability, demand, and home values. In this expanded guide, we explain how interest rate changes impact buyers and sellers—especially in Virginia—and offer tips for navigating the current market.

Understanding Interest Rates and Mortgages

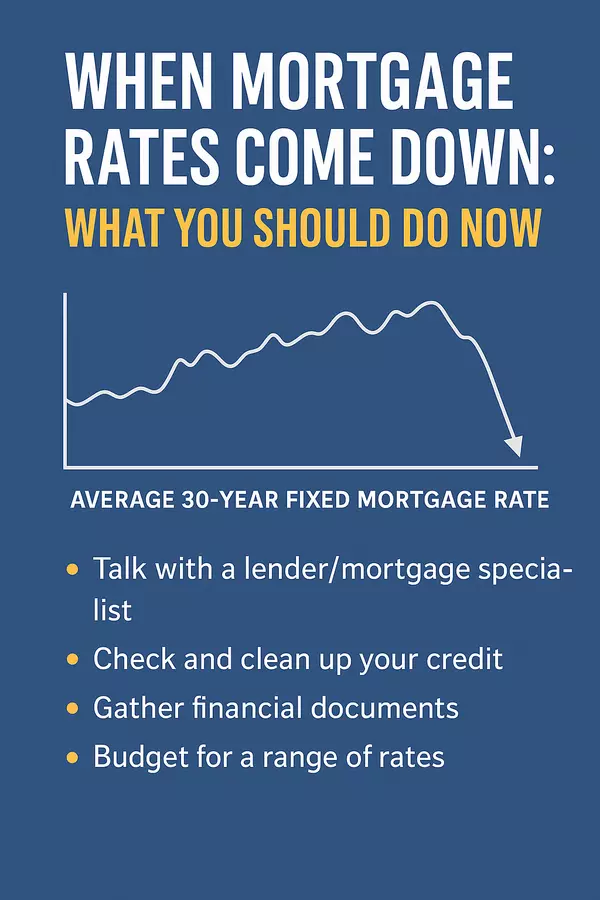

Interest rates reflect the cost of borrowing money. The Federal Reserve adjusts its benchmark rate to manage inflation and economic growth. Mortgage rates usually follow these trends. When mortgage rates rise, the monthly cost of a home loan increases, reducing affordability.

For example, a $400,000 mortgage at 3% interest costs about $1,686/month (principal & interest), but at 7%, it jumps to roughly $2,661—a nearly $1,000 increase. This kind of change can limit what buyers can afford and reduce competition in the market.

How Higher Rates Affect Buyers

Rising interest rates shrink buying power and often push first-time buyers out of the market. In 2022 and 2023, when rates climbed past 7%, mortgage applications fell to their lowest levels in decades. However, even small rate drops can quickly revive interest. In April 2025, a slight decrease in mortgage rates to around 6.6% led to a 20% jump in applications.

What This Means for Sellers

With fewer buyers in the market, sellers may need to be more flexible. While homes are still selling, especially well-maintained ones in desirable locations, the days of multiple offers above asking are less common. That said, limited inventory has helped support home prices.

Many homeowners are holding onto their properties because they’re locked into low interest rates from 2020–2021. This "lock-in effect" has kept housing supply tight, which is why prices haven’t dropped significantly despite lower demand.

Virginia Market Highlights (2022–2025)

-

2023: Virginia home sales dropped 20% from the previous year, reaching their lowest level in nearly a decade.

-

2024: A modest recovery began. Sales increased 4% year-over-year, and December sales were up 14% compared to the previous December.

-

Prices: Despite slower activity, home prices in Virginia continued to rise. The median sale price reached $413,490 in December 2024—up about 8% from a year earlier.

-

Inventory: Remains low. Even as listings rose slightly in late 2024, supply is still well below balanced market levels.

Tips for Buyers

-

Know your budget: Get pre-approved and understand your payment at today’s rates.

-

Improve your credit: Higher scores can help you secure better rates.

-

Explore options: Consider adjustable-rate mortgages or negotiate seller-paid rate buydowns.

-

Be prepared: When rates dip, competition heats up quickly.

Tips for Sellers

-

Price right: Overpricing can result in your home sitting on the market.

-

Offer incentives: Help buyers with closing costs or rate buydowns.

-

Highlight your home’s strengths: Good presentation matters more in a slower market.

-

Stay flexible: Expect more negotiations and longer days on market.

The Bottom Line

Interest rates play a central role in real estate. While higher rates have cooled activity, Virginia’s housing market remains resilient due to low inventory. Buyers and sellers alike need to stay informed, flexible, and prepared to act when opportunities arise.

Want help navigating this market? Reach out today for expert guidance tailored to your goals.

Categories

Recent Posts

GET MORE INFORMATION