When Mortgage Rates Come Down - What You Should Do Now (Full Guide)

Introduction

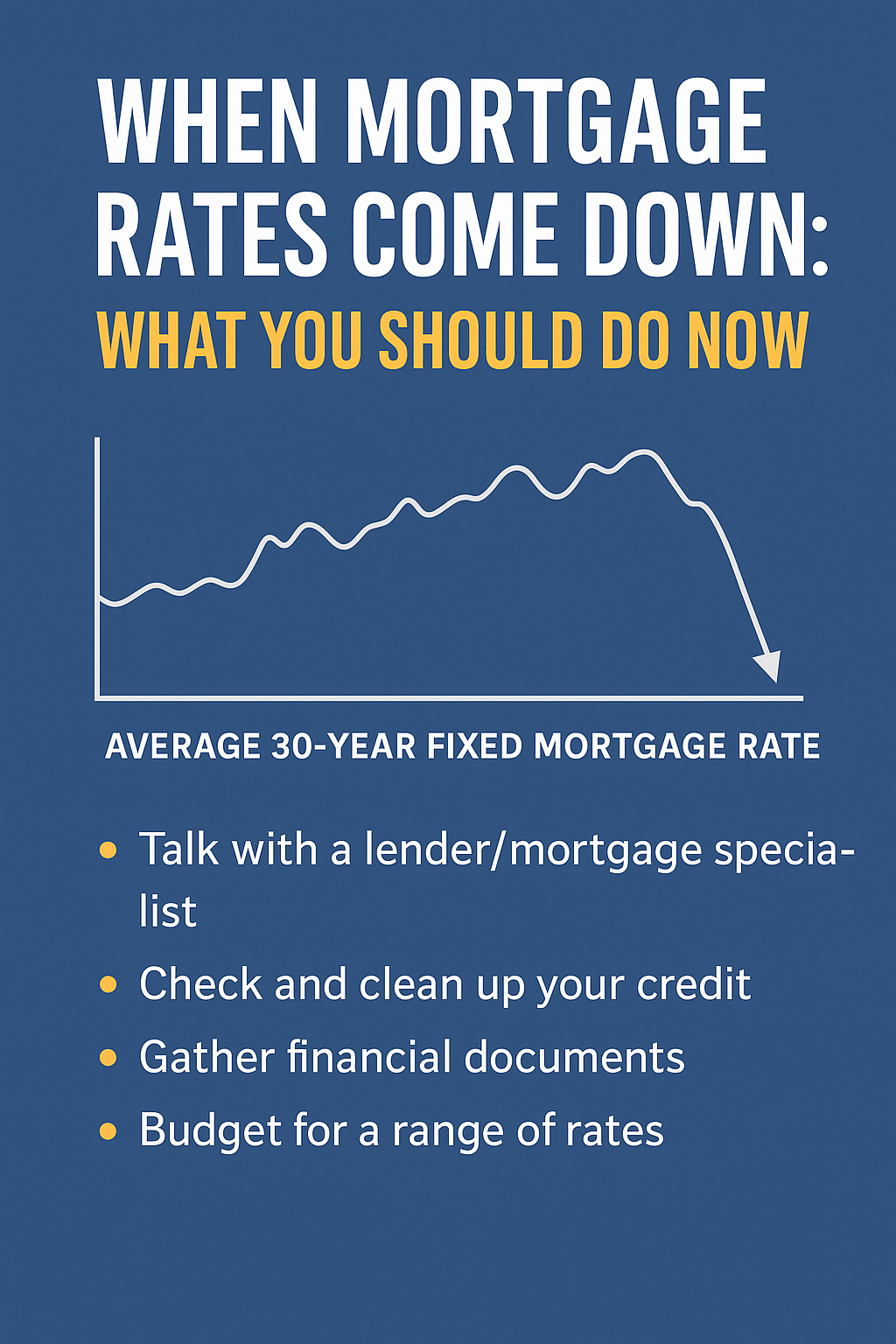

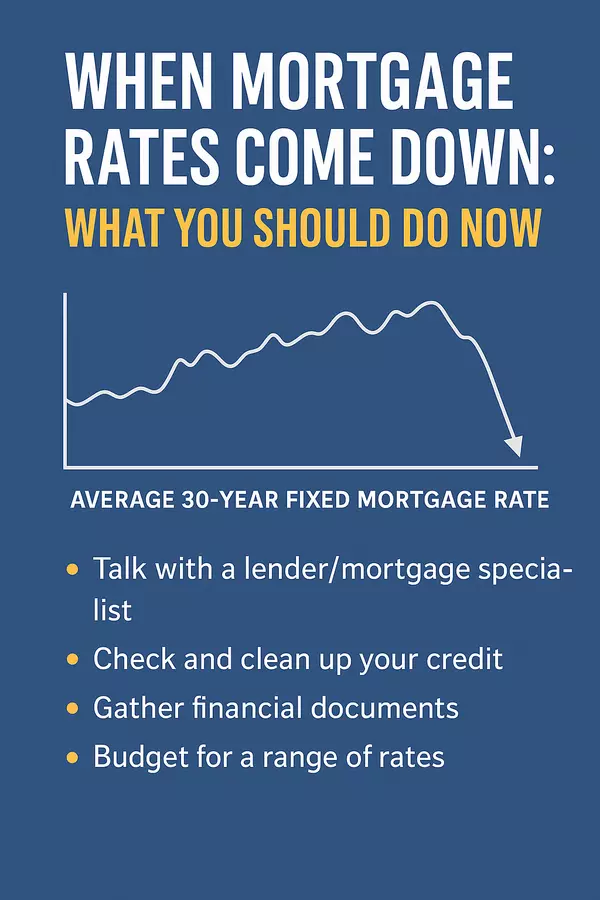

Mortgage rates have been high for a while, and that’s kept many buyers and sellers on the sidelines. But lately, things are showing signs of change. The average 30-year fixed mortgage rate is back around 6.34%, up slightly in the latest week. Freddie Mac+2GlobeNewswire+2 That is still lower compared to some earlier periods, and many analysts now predict modest easing ahead. Capital Markets+2Norada Real Estate+2

Declines in mortgage rates could prompt more activity in real estate - more buyers entering the market, more refinancing, and more competition. But to take advantage, you need to prepare yourself before the shift happens.

This guide gives you everything you need: how rates have moved, what to expect, what you can do now, and how to be ready when rates ease.

How Have Rates Behaved Lately?

-

In mid-September 2025, Freddie Mac’s survey showed the 30-year fixed rate averaged 6.26%, following a drop from 6.35% earlier. National Apartment Association+2Freddie Mac+2

-

On October 2, 2025, the 30-year fixed rate averaged 6.34%, up from 6.30% the prior week. Freddie Mac+1

-

The 15-year fixed averaged 5.55% on that same date. Freddie Mac+2Freddie Mac+2

-

Over the past year, rates have fluctuated but often stayed below the 52-week average. RTT News+1

These movements show that rates are volatile, but there is room for easing based on economic data, inflation, and Fed policy shifts.

What Experts Are Predicting

-

In its quarterly outlook, Freddie Mac suggests that as mortgage rates decline after peaking around 7% in spring 2024, many homeowners who locked in higher rates may refinance. Capital Markets

-

Some forecasts project that by end of 2025, mortgage rates could settle in the mid-6% range, possibly easing further in 2026. Norada Real Estate+2Forbes+2

-

According to Forbes, the National Association of Home Builders (NAHB) expects the 30-year fixed rate to average in the mid-6% range by year-end. Forbes

The takeaway: don’t expect a dramatic crash to 4% instantly. More likely is a gradual decline, dependent on inflation, economic growth, and Fed decisions.

Why a Rate Drop Matters

-

More Buying Power: Even a half-point drop in interest can save you hundreds monthly and significantly increase the amount of house you can afford.

-

Increased Competition: As rates ease, more buyers will enter the market. If you’re already prepped, you have a head start.

-

Refinancing Window: Homeowners with higher rates now may find an opportunity to refinance and lower payments.

-

Tight Inventory + Timing: Because many current homeowners are “locked in” to low rates, fewer houses are listed. When rates fall, supply may not keep up immediately, so prepared buyers benefit most.

What You Should Do Right Now to Be Ready

Here’s your playbook:

-

Talk with a Lender / Mortgage Specialist

-

Get prequalified (or preapproved) so you know where you stand.

-

Ask what kind of rate and terms you currently qualify for.

-

Save or lock the quotes you get now for comparison.

-

-

Check and Clean Up Your Credit

-

Pay down credit card balances.

-

Avoid opening new lines of credit.

-

Review your credit report for errors and resolve them.

-

-

Gather Financial Documents

-

W-2s, tax returns, pay stubs, bank statements.

-

Having this ready speeds the process.

-

-

Budget for a Range of Rates

-

Don’t assume rates will drop below where they are now.

-

Plan with scenarios: if your rate is 6.3%, 6.0%, or 5.7%. Know your max payment.

-

-

Stay Informed

-

Follow inflation reports, Fed announcements, and bond yields.

-

Local and national economic news can signal rate movement.

-

-

Get Ready to Move Quickly

-

Be ready to submit offers as soon as a home appeals to you.

-

Have your team lined up (lender, inspector, agent) so you can act fast.

-

What Happens When Rates Drop

-

More Buyers Flood Market: This pushes up demand and can lead to multiple offers on desirable homes.

-

Refinance Rush: Homeowners locked in higher rates may seize the chance to refinance.

-

Stricter Lending Standards: When rates drop, lenders often tighten guidelines to control risk.

-

Speed Matters: The prepared buyers will often beat the competition to strong deals.

Realistic Expectations & Risks

-

Rates could stabilize or even creep up again depending on inflation, economic surprises, or Fed moves.

-

A gradual decline is more likely than a steep drop.

-

Not every home will bring fantastic deals. Timing, price, condition, and location always matter.

Your Next Step

Rates may come down, but the buyers who win will be ready before the shift. If you’d like help:

-

I can connect you to trusted local lenders.

-

I can strategize with you so when things move, you move faster.

Reach out whenever you’re ready. Let’s make sure you’re positioned ahead.

— Zach

Eppard Real Estate Solutions

540-755-3919

zleppard99@gmail.com

Categories

Recent Posts

GET MORE INFORMATION